does indiana have estate or inheritance tax

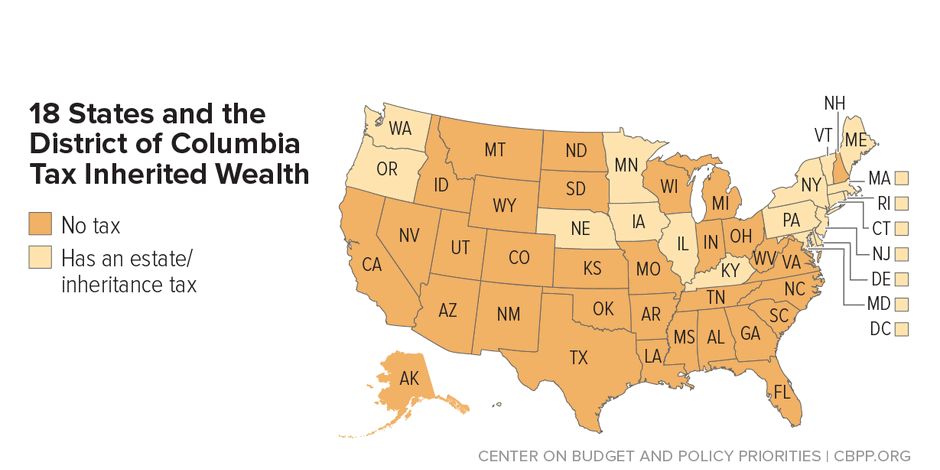

At this point there are only six states that impose state-level inheritance taxes. Inheritance tax also has different tax rates than estate tax.

.png)

Iowa Inheritance Tax Law Explained

Indiana inheritance tax was eliminated as of January 1 2013.

. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Although some Indiana residents will have to pay. How much money can you inherit without paying inheritance tax.

Therefore no inheritance tax returns must be filed at this time. On the federal level there is no inheritance tax. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property.

Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax is Due on the Transfer Form IH-TA and notices that life insurance proceeds have been paid to an. Here in Indiana we did have an inheritance. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The rate changes based on the relationship between the deceased and the inheritor. Indiana repealed the inheritance tax in 2013. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other. If you have received an inheritance or know you will be receiving one and live in one of the states that impose the. 45 when property passes.

When someone dies without leaving a valid will in Indiana they are subject to the states intestacy laws. This means the estate will be divided between the surviving next of kin. Indiana has no state.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your. Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

Of course Indiana cannot change federal law and there does remain in existence a Federal Estate Tax. Does Indiana Have Estate Or Inheritance Tax. Instead some Indiana residents may have to pay federal estate taxes.

To the extent that there is any good news about a tax because of the credits. Indiana does not have its own inheritance or estate taxes. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption.

States With No Estate Or Inheritance Taxes

Indiana Inheritance Laws What You Should Know Smartasset

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Fillable Online Motion To Show Cause Fillable Form Indiana Fax Email Print Pdffiller

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

State Death Tax Hikes Loom Where Not To Die In 2021

Inheritance Tax Here S Who Pays And In Which States Bankrate

Transfer On Death Tax Implications Findlaw

Estate And Inheritance Tax State By State Housing Gurus

States With No Estate Or Inheritance Taxes

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know Inside Indiana Business

What Is Inheritance Tax Probate Advance

:max_bytes(150000):strip_icc():gifv()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)